If you have a mortgage on your home, chances are good you also have mortgage insurance. The idea is that if you should become seriously ill or die before paying off the mortgage, the coverage will kick in and pay it off for you. It's meant to offer peace of mind and to reassure you that your family will be able to stay in your home if anything should happen to you.

If you have a mortgage on your home, chances are good you also have mortgage insurance. The idea is that if you should become seriously ill or die before paying off the mortgage, the coverage will kick in and pay it off for you. It’s meant to offer peace of mind and to reassure you that your family will be able to stay in your home if anything should happen to you.

The reality falls a little short of that. In this week’s Marketplace investigation, we meet two families who bought the coverage and thought they were protected, only to have their claims denied when they became sick or died. In each case, the insurer said the applicant person had lied on their initial application form.

It turns out a routine test at the doctor could be reason to deny your claim, if you don’t mention it. Had a cuff inflated on your bicep? That counts as being tested for high blood pressure.

As Erica Johnson reports, the bank staffers selling mortgage insurance are unlicenced and rarely trained to explain the details and legalities of those insurance products. The result is people who pay premiums and think they are covered, only to realize later that they are not.

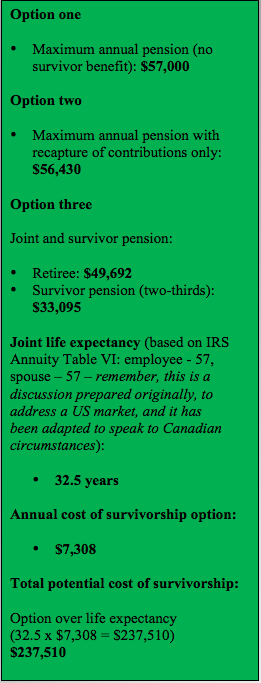

57-year-old female government retiree. Under her defined-benefit pension plan, the retiree qualified for a life pension of $57,000, which had the actuarial annuity or lump-sum economic value of about $806,207. At retirement, the retiree, who is married, had to choose from three options:

57-year-old female government retiree. Under her defined-benefit pension plan, the retiree qualified for a life pension of $57,000, which had the actuarial annuity or lump-sum economic value of about $806,207. At retirement, the retiree, who is married, had to choose from three options: known as a joint and survivor pension. Once they select this option, however, it cannot be changed in most cases.

known as a joint and survivor pension. Once they select this option, however, it cannot be changed in most cases. whole life insurance for about $8,600 per year. This strategy is widely used and has been implemented extensively in pension maximization circumstances for people.

whole life insurance for about $8,600 per year. This strategy is widely used and has been implemented extensively in pension maximization circumstances for people.