Insuring seniors is costly!!

INSURING SENIORS IS COSTLY, BUT IT’S WORTH IT!

It’s a well understood truth that the best deal on life insurance can be had when the client is young and in relatively good health. But just because the premiums on seniors are much higher, the need for insurance in your golden years may still be a good deal.

There’s no shortage of worst case scenarios, ranging from larger-than-expected tax liabilities to the failure of a pension plan.

Adapted from an article written by Al Emid that appeared in ADVISOR.CA on March 14, 2011. This discussion has been modified and amended to address a public audience.

Even good news can conspire against the client: with longer life expectancies and earlier retirements, there is a higher likelihood that medical and living expenses will consume retirement assets.

At the same time, it has become more common – even socially acceptable – to carry debt into retirement. A Harris-Decima poll last August for CIBC found that only 35% of Canadians in the 55 to 64 year age group are debt-free and that 8% of respondents believe they will be in their 70’s before clearing their debts. Another 10% have no hope of ever becoming debt free.

In today’s environment – not like our parents‘ environment – there are a lot of people retiring with a mortgage or perhaps a long line of credit or they’ve signed for their kids to get their houses. There are a lot of reasons for seniors to be worried. They don’t have a debt free environment anymore.

Another common problem is that estates of baby boomers may face unexpectedly high tax bills. In the stereotypical scenario, parents bequeath the family cottage to their children, along with a massive capital gain, thanks to soaring vacation property values.

Some aim to shield beneficiaries from their debt. They want to make sure that debt is paid off when they pass away.

Carrying debt to the grave and unexpected tax bills illustrate the importance of term and permanent insurance in a senior’s protection portfolio.

Not all insurers provide coverage at the top of the age brackets, however. This can affect the availability of insurers with whom to write contracts.

Tracking differences can be a challenge, as well, since there are over 2,400 life insurance products and variations available in the Canadian market.

In the term insurance category, some insurers will not underwrite policies after the individual turns 65. Many will, however, renew term coverage up to 85 years of age when the policy ends, and a rare few will renew term coverage up to age 100.

Renewal costs on a term policy average four times the original premium – for those with additional risk factors, like tobacco use, that can rise to six times the original premium.

If the insured individual has remained in good health, a broker may be able to get an entirely new policy for a client at a lower cost than the renewal cost.

Applicants that are still in good health can look at applying for a new term 10 (T10) with medical evidence, rather than just letting the (existing) policy renew on its own, but this process should be concluded before the old policy lapses.

Changing policies, however, means exposure to a new two-year term of incontestability and the suicide exclusion.

In the permanent insurance category, underwriting age limits vary between companies and product lines.

The number of companies providing term 100 (T100) coverage has decreased in recent years and some companies that currently offer it are expected to drop it from their line-up, since underlying costs have proven higher than originally calculated.

To a senior who is already concerned about his/her debt purchasing life insurance coverage might be a difficult concept to come to terms with, but when the effect that debt and taxes can have on an estate is considered it can be a welcome strategy to consider.

People should also be reminded that survivor benefits on some pension plans provide only 60% of the original payment to the surviving spouse after the plan-holder deceases.

Given that the end beneficiaries of the life insurance policy are often the senior insured’s adult children, it might make sense for them (the children) to purchase the policy on the lives of their parents, to shield their inheritances on their parents’ deaths. In this fashion the children would own the policy. They would have the ability to use it to pay the taxes or keep the cottage.

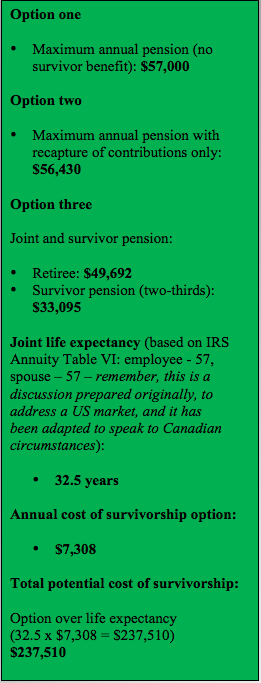

57-year-old female government retiree. Under her defined-benefit pension plan, the retiree qualified for a life pension of $57,000, which had the actuarial annuity or lump-sum economic value of about $806,207. At retirement, the retiree, who is married, had to choose from three options:

57-year-old female government retiree. Under her defined-benefit pension plan, the retiree qualified for a life pension of $57,000, which had the actuarial annuity or lump-sum economic value of about $806,207. At retirement, the retiree, who is married, had to choose from three options: known as a joint and survivor pension. Once they select this option, however, it cannot be changed in most cases.

known as a joint and survivor pension. Once they select this option, however, it cannot be changed in most cases. whole life insurance for about $8,600 per year. This strategy is widely used and has been implemented extensively in pension maximization circumstances for people.

whole life insurance for about $8,600 per year. This strategy is widely used and has been implemented extensively in pension maximization circumstances for people.