Types of Life Insurance

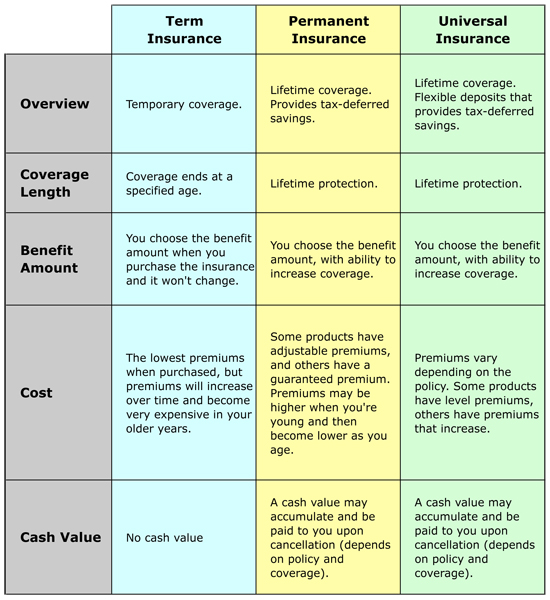

Basically, there are three types of life insurance contracts that you need to know about:

Term, Permanent (often referrred to as “whole life” insurance), and Universal Life insurance.

Term life insurance

Term life insurance is the most traditional and best-known form of personal coverage, paying out to the policyholder’s dependents in the case of death. The main advantage of this insurance is that it is lower priced initially than other types of insurance, but it offers few other benefits.

This type of coverage typically operates for a fixed term of 10 to 30 years, depending upon the policy, and pays out the benefit amount if the policyholder dies.

Permanent (or “Whole Life”) Life Insurance

Permanent life insurance offers coverage for a lifetime, with a guaranteed payout upon death.

You choose the death benefit that will be paid upon death. You make payments in to the policy fund. Any amount you pay into the fund in excess of the cost of insurance (the premium) provided by the life insurance contract is invested and builds a cash sum over time. This cash investment enables the value of the death benefit to increase, or allows loans to be taken against the policy, with many people seeing this as a viable income stream for their retirement plans.

Universal Life Insurance

Universal life insurance offers an extremely flexible middle way, combining life cover with the chance to build up an investment income, at a lower cost than fixed permanent life cover.

This type of cover can be very flexible and allows payments to be varied, depending upon the current financial circumstances of the policyholder. Money paid over and above the normal premium can be used to either increase the cash value or increase the death benefit.

Summary

The three types of policies: TERM, UNIVERSAL, and PERMANENT (or “Whole Life”) insurance offer different benefits depending upon the needs of the policyholder.

The most affordable option, a simple Term policy, offers temporary coverage, but no other investment potential, and is usually a prerequisite when taking out a mortgage or a large loan.

Permanent (or “Whole Life”) and Universal Life insurance contracts are more flexible, offering tax-free investment potential alongside the lifetime coverage, allowing money to be invested into the death benefits or the investment account.

It is always important to seek independent financial advice before committing to any major financial decision and to be aware of all the long term investment opportunities available.

One of the easiest ways for you to make an informed decision before you buy life insurance is to sit down with a Financial Advisor to evaluate your situation. A Financial Advisor can help you determine the type of insurance coverage that is best for your unique situation.

Question or concern about Life Insurance?

Call Firth Bateman: (604) 591-1336

Life Insurance

Delta, BC