BC Finance Minister, Michael de Jong delivered the province's 2017 budget on Feb. 21, 2017. Learn what the budget means for small business owners and individuals.

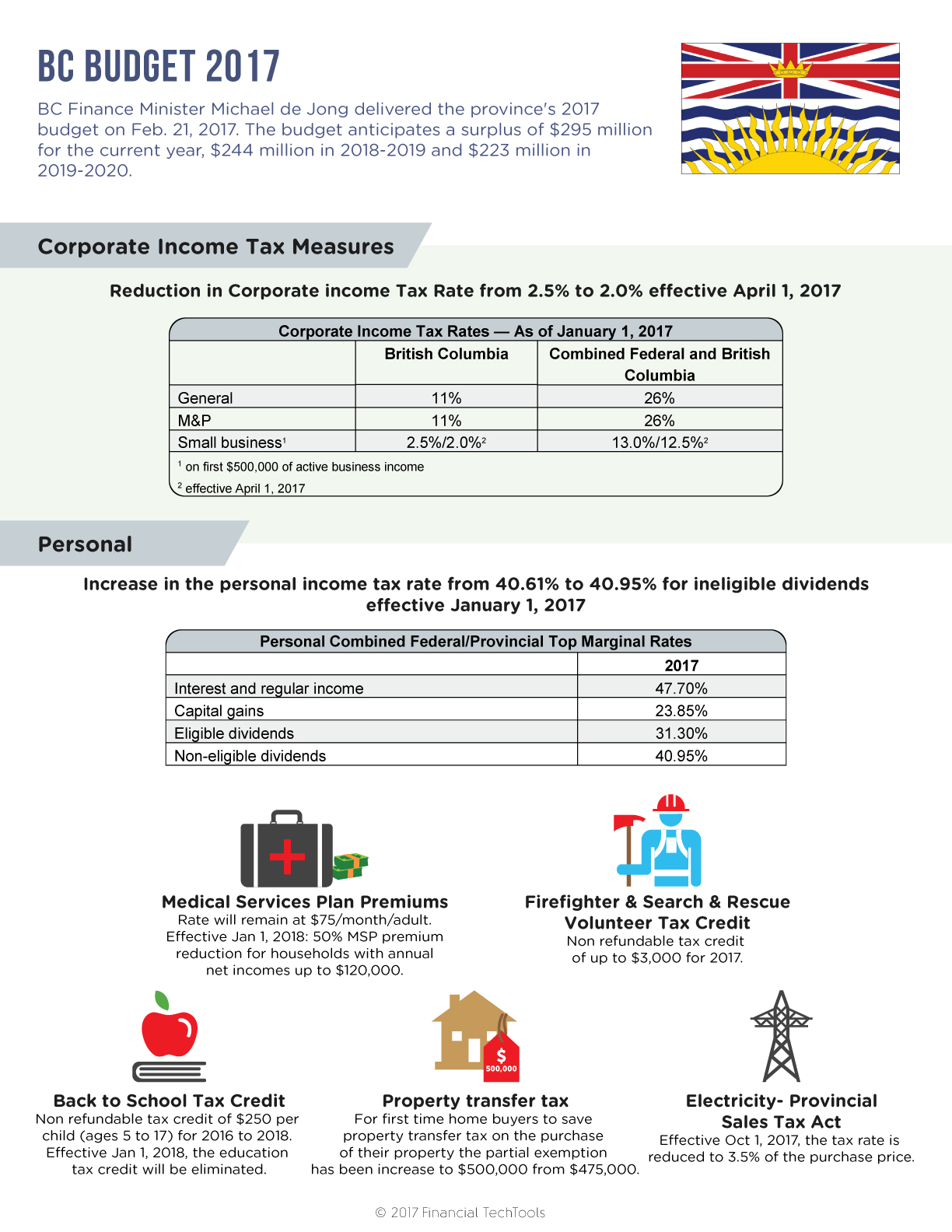

BC Finance Minister Michael de Jong delivered the province’s 2017 budget on Feb. 21, 2017. The budget anticipates a surplus of $295 million for the current year, $244 million in 2018-2019 and $223 million in 2019-2020.

Corporate Income Tax Measures

Reduction in Corporate income Tax Rate from 2.5% to 2.0% effective April 1, 2017

| Corporate Income Tax Rates- As of January 1, 2017 | ||

| British Columbia | Combined Federal & BC | |

| General | 11% | 28% |

| M&P | 11% | 26% |

| Small Business* | 2.5%/2.0%** | 13.0%/12.5%** |

| *on first $500,000 of active business income **effective April 1, 2017 | ||

Personal

Increase in the personal tax rate from 40.61% to 40.95% for ineligible dividends effective January 1, 2017.

| Personal Combined Federal/Provincial Top Marginal Rates | ||

| 2017 | ||

| Interest and regular income | 47.70% | |

| Capital gains | 23.85% | |

| Eligible dividends | 31.30% | |

| Non-eligible dividends | 40.95% | |

Medical Services Plan Premiums: Rate will remain at $75/month/adult. Effective Jan 1, 2018: 50% MSP premium reduction for households with annual net incomes up to $120,000.

Firefighter & Search & Rescue Volunteer Tax Credit: Non-refundable tax credit of up to $3,000 for 2017.

Back to School Tax Credit: Non-refundable tax credit of $250 per child (ages 5 to 17) for 2016 to 2018. Effective Jan 1, 2018, the education tax credit will be eliminated.

Electricity- Provincial Sales Tax Act: Effective Oct 1, 2017, the tax rate is reduced to 3.5% of the purchase price.

Property transfer tax: For first time home buyers to save property transfer tax on the purchase of their property the partial exemption has been increased to $500,000 from $475,000.