PENSION MAXIMISATION: WHAT IS IT?

A discussion exploring a strategy for ensuring

maximum income through retirement,

brought to you by the associates of

FB FINANCIAL & Associates . . .

Maximizing Your Pension . . .

If you or your spouse is healthy, consider purchasing a

permanent life insurance contract a few years before

retirement.

Adapted from an article by Barry J. Dyke – a member of NAIFA-New Hampshire and an agent and advisor for more than two decades. This article is excerpted from his book, The Pirates of Manhattan, which is about the monetary system, finance and permanent life insurance. Contact him at 800-335-5013 or at castleassetmgmt@comcast.net. The original article is written to address an American audience, but the concept translates easily to speak to the Canadian fiscal context.

If you have a defined-benefit pension plan, you should not only consider yourself lucky but you should also understand that a lifelong guaranteed pension can have a high economic value. Also, a defined-benefit pension plan in the private sector is protected by the terms of the Government of Canada Pension Benefits Standards Act, 1985 (PBSA). Such a plan, as well, has an even higher value if it provides a guaranteed income for life for a retiree and spouse.

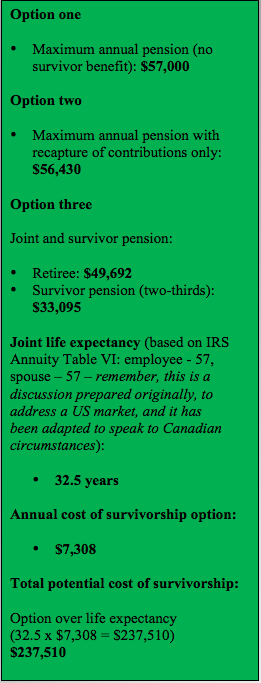

For instance, let’s look at the recently calculated, approximate value of a pension for a  57-year-old female government retiree. Under her defined-benefit pension plan, the retiree qualified for a life pension of $57,000, which had the actuarial annuity or lump-sum economic value of about $806,207. At retirement, the retiree, who is married, had to choose from three options:

57-year-old female government retiree. Under her defined-benefit pension plan, the retiree qualified for a life pension of $57,000, which had the actuarial annuity or lump-sum economic value of about $806,207. At retirement, the retiree, who is married, had to choose from three options:

- The maximum income for life: No benefits, however, would be paid to the surviving spouse if she predeceased her husband.

- A life pension of slightly less: If the retiree predeceased her husband, he would get a partial recovery of her plan contributions.

- A substantially reduced pension for life: The pension, however, would cover her and her husband and guarantee both of them a pension for life.

Many retirees in this situation feel compelled to take the reduced lifetime income, commonly known as a joint and survivor pension. Once they select this option, however, it cannot be changed in most cases.

known as a joint and survivor pension. Once they select this option, however, it cannot be changed in most cases.

Points to ponder:

There are several important things you should consider before deciding to take reduced pension benefits:

- If the retiree lives a short time, the surviving spouse faces a lifetime of reduced pensions.

- If they both live a full life and die within a year or so of each other (which is not unusual), little benefit, if any, is realized after 20 or more years of reduced pension income.

- In either case, the children of the retiree and spouse will never inherit any benefits.

Let’s review (“green” box, to the right) the potential costs associated with the retiree who was considering the $57,000 pension for life. Keep in mind that this is only an example:

In conclusion (after our review), the pension survivorship option is just like expensive term life insurance – and may never pay a benefit.

A better way

An alternative is pension maximization, via which you purchase a life insurance policy before you retire in an amount that would give the survivor or other heirs a similar monthly benefit. For example, you couldbuy a universal life policy for about $471,000, which would fund a survivor pension/annuity option if interest rates are at 4.25 percent for the next 30 years. The annual premium or deposit into the life insurance would be $7,308.

Conversely, a low-premium whole life insurance contract, which would guarantee the death benefit and provide cash values as an additional economic asset, would cost approximately $11,000 per year.

The best way

The best way to maximize your pension if you are healthy four or five years before retirement is for you to buy low-premium whole life insurance for about $8,600 per year. This strategy is widely used and has been implemented extensively in pension maximization circumstances for people.

whole life insurance for about $8,600 per year. This strategy is widely used and has been implemented extensively in pension maximization circumstances for people.

Suppose, for example, a retiree’s spouse predeceases the retiree. The retiree still receives the maximum pension. The life insurance proceeds are now directed to the retiree’s adult children— something that would not have happened under a traditional joint and survivor pension arrangement.

In another situation, a retiree has accumulated so much cash in his/her life insurance contract that he/she can now finance the purchase of his/her automobiles with his/her life insurance loans instead of using bank loans. He/she is still in excellent health, although his/her spouse’s health is failing. The pension-maximization strategy established will work better for adult children who are heirs to the estate.

Some caveats

Pension maximization does not work in all circumstances, however. Someone whose health has deteriorated is not a good candidate for permanent life insurance, which is the fundamental component and economic workhorse of a structurally strong pension-maximization strategy.

Here are some things to keep in mind as you consider a pension maximization strategy:

- Life insurance proceeds to the survivor are income-tax free, whereas survivor pension benefits are fully taxable as ordinary income.

- If annuitized at an older age, the survivor will have a larger monthly income than he/she would under a traditional joint and survivor option. If life insurance proceeds are annuitized, a large part of that benefit will be income-tax free as a return of principal under the exclusion ratio.

- If a retiree and his/her spouse die simultaneously, insurance benefits could pass to other heirs, such as their children.

Life insurance can provide additional benefits such as long-term care insurance and accelerated death benefits if the policy owner has a terminal illness.

- If the survivor recipient of the pension predeceases the retiree, the policy can be put into a reduced paid-up mode, whereby no further premiums are required at a reduced life insurance benefit. The retiree could also surrender the policy for its cash value if need be, or borrow against it, even in a reduced paid-up mode.

- If the retiree’s spouse predeceases him/her and the retiree remarries at a later date, the new spouse can be named the beneficiary of the policy.

FB FINANCIAL & Associates

Firth Bateman

Principal / Associate

e-mail: Firth.Bateman@telus.net

web: http://www.fbfinancial.ca

NORTH DELTA OFFICE

11921 80 Avenue, Delta, BC V4C 1Y1

PH: 604.591.1336 FX: 604.596.2223